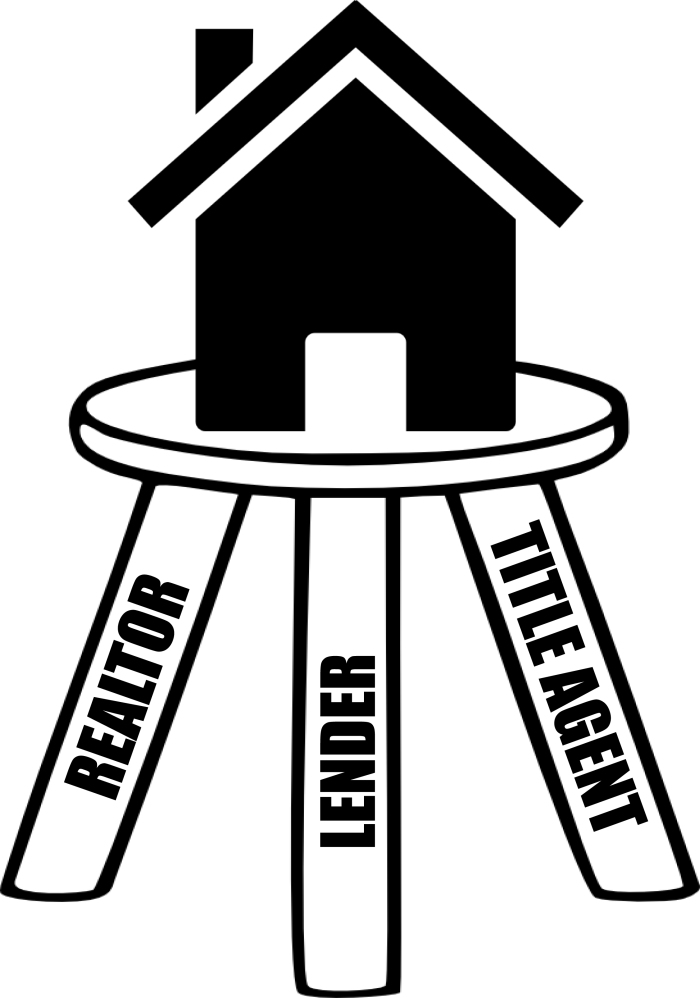

Today officially kicks off National Homeownership Month, and our goal is to help educate and prepare future home buyers for the home buying process. In our last post, we compared buying a home to standing on a stool. It takes a lot of balance, and to keep from falling, you’ll need all three legs of the stool working together to hold you up.

Today we’ll focus on the second leg of the stool, the lender. The lender helps you finance the home you want to purchase. This part of the home buying process can be very complex, and understanding it end-to-end is important. Many people feel overwhelmed because of the amount of paperwork to be completed, but knowing what to expect will help you make sound decisions about your home purchase. The more knowledgeable you are the better, but a good lender will be by your side every step of the way to prepare you for what happens next.

Pre-Qualification

The first person you’ll meet during this part of the process is your loan officer. Your loan officer can assess your creditworthiness and determine your eligibility to purchase a home prior to you formally applying for a home loan through the “pre-qualification” process. They’ll also evaluate your household income, debt, and assets to determine your “buying power”, or how much you can afford. Your loan officer will discuss various loan types and terms of mortgages with you. Loan officers are mortgage specialists, so they’re a good resource for helping you determine which mortgage option best suits your financial situation. Having a letter of pre-qualification from a lender can help strengthen your negotiating position when making an offer on a home. Keep in mind that you are not obligated to obtain financing from the lender who pre-qualifies you.

Preparation

Federal law requires your lender to provide you with a Loan Estimate, which includes a summary of your settlement charges, within three days of applying for a loan; however, prior to making an offer on a specific home, you can ask your loan officer to provide you with an estimated cost to close. Doing so will provide you with an estimate of the amount of closing costs, escrows and prepaids you’ll need in order to purchase the home. Having this information early may be helpful when budgeting the out-of-pocket costs of your home purchase.

Application

Your pre-qualification is not a guarantee that you’ll be approved for a loan. Once you have a signed purchase agreement on the home you intend to buy, you’ll formally apply for a mortgage. Again, you’re not obligated to apply with the same lender who pre-qualified you. During this stage of the process, you will likely meet your loan processor. The processor’s job is to prepare your loan information and application for presentation to the underwriter. You’ll provide your processor with the appropriate documentation necessary to apply for your loan. Your processor will ask you for a variety of documents, including, but not limited to, tax returns, W-2s, bank statements and pay stubs. Your processor ensures that all the proper documentation is included in your file, all numbers are calculated correctly, and everything is in the proper order. They will then send your file to the mortgage underwriter.

Authorization

Your underwriter is the decision maker and is authorized to assess whether or not you’re eligible for the mortgage loan you’re applying for. Your underwriter will ultimately approve or reject your loan application based on your creditworthiness, employment history, assets, debts, and other factors.

Once you’ve completed the application process, your loan officer will provide you with a variety of documents outlining the costs associated with your loan, including the Loan Estimate and Closing Disclosure, to help prepare you for closing. These forms are required by law, for your protection. As noted earlier, within three business days of completing your loan application, your loan officer must provide you with a Loan Estimate which provides you with an estimate of your loan terms and details of your settlement charges should you be approved for a mortgage loan. Once the underwriter approves the loan, your loan officer is required to provide you with your Closing Disclosure at least three business days before your scheduled closing is to occur. This tool allows you to double-check that all of your loan details are correct. Once you approve your Closing Disclosure, you’ll be ready to move forward to the closing.

Your lender is a lot like your Realtor®. They also work for you 24/7 — whether you need a little more information or guidance, have questions about what happens next, or just need a shoulder to lean on in order to feel at ease. Buying a home is likely the biggest financial decision of your entire life, and your lender doesn’t take this lightly.

To verify a lender, please visit www.nmlsconsumeraccess.org

“No representation is made that the quality of legal services to be performed is greater than the quality of legal services performed by other lawyers.”